Get to know the most common method of trading cryptocurrencies!

There are many ways to make money from the digital currency market. Cryptocurrency trading is one of the common ways to get rich from the cryptocurrency market. There are many ways to trade in this market, the most common of which is spot trading. Generally, this type of trading is compared to futures trading. In this article, we explain this trading concept.

Table of Contents

• What is Spot Trading in Crypto?

• The concept of Order Book in the spot market

• What is the priority of orders in the order book?

• The concept of Ask and Bid and liquidity power

• Which spot market is better, OTC or exchange?

• Advantages and disadvantages of spot trading

What is Spot Trading in Crypto?

Before dealing with how to conduct transactions using this method, we first explain the meaning of this phrase. Spot refers to a transaction in which the delivery of the purchased or sold goods takes place at the time of the transaction.

The essential element of a spot transaction is the immediate delivery of the traded commodity. Trading also means trading and exchanging goods.

So, spot trading refers to transactions in which the traded goods are exchanged between the buyer and seller at the time of the transaction. For example, in a spot bitcoin transaction, bitcoin is transferred from the seller to the buyer during the trade.

This type of trading can be considered the opposite of Bitcoin futures. In futures transactions, the goods will be exchanged between the buyer and the seller in the future and on the date specified in the contract.

Spot trading is a common way to make money from the cryptocurrency market, and is compared to futures trading. It involves the immediate delivery of the traded commodity, and is the opposite of Bitcoin futures, where the goods will be exchanged between the buyer and seller in the future and on the date specified in the contract.

What is the Spot Price?

You may have come across the term Spot Price in some texts. This expression is usually used to express the price of an asset; for example, the spot price of Bitcoin is $13,400.

You probably guess the meaning of this phrase: “spot price of bitcoin” means that if someone wants to buy this cryptocurrency right now, he has to pay $13,400. The spot price is determined by individual traders of Bitcoin or any other asset and is constantly changing.

What is Spot Market?

Spot market, which is generally called the physical market or cash market, is a market where you can buy and sell bitcoin or other digital currencies instantly. In this market, Bitcoin is traded in the real form, and the amount of BTC is transferred from the seller’s wallet to the buyer’s (or from the trading account).

Binance Exchange offers both spot and futures markets for Bitcoin trading. At the time of this writing, the price of Bitcoin in the spot market of the Binance exchange is $18.351, but its price in futures market of Binance is $18.380.

As you can see, the price of Bitcoin is different in the spot and futures markets on the same exchange because the nature of these markets is different.

Spot Price is an expression used to express the price of an asset, such as Bitcoin. It is determined by individual traders and is constantly changing. Spot Market is a market where you can buy and sell bitcoin or other digital currencies instantly. Binance Exchange offers both spot and futures markets for Bitcoin trading, with the price of Bitcoin in the spot market of the Binance exchange being $18.351, but its price in the futures market of Binance is $18.380.

The concept of Order Book in the spot market

An order book is a list of buy and sell orders for an asset submitted by individual people in that exchange or market. To illustrate this concept in financial markets, consider that people who want to buy bitcoins place their purchase order on an exchange. At the time of placing the order, each of them will announce their bid price and the amount of BTC they intend to buy.

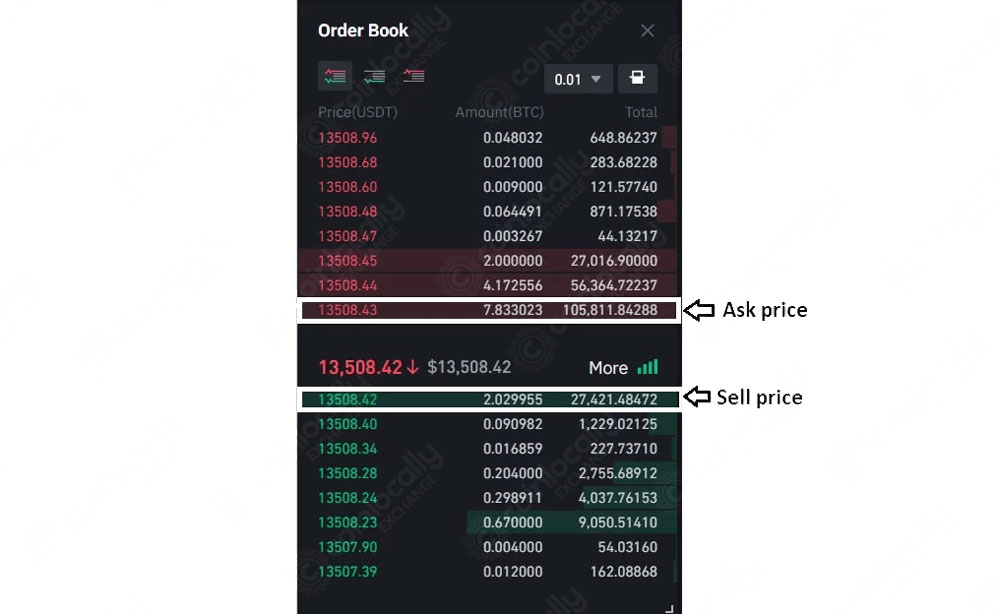

On the other side of the market, there are people who want to sell their bitcoins. These people are the buyers and sellers of Bitcoin. The exchange displays all buy and sell orders for individuals in a single list.A list of buyers and sellers is referred to as an order book.The image below shows the Bitcoin Order Book on the Binance exchange.

What is Spot Trading in Crypto?

This order book is constantly changing because as soon as a buyer and seller agree on a price, the transaction is executed by Binance, and BTC is transferred from the seller to the buyer. As you can see in the image above, each Order Book consists of two parts: buyers and sellers. Buyers’ orders are displayed in green, and sellers’ orders are displayed in red.

An Order Book is a list of buy and sell orders for an asset submitted by individual people in an exchange or market. It is used to illustrate the concept of spot trading in financial markets. The image below shows the Bitcoin Order Book on the Binance exchange, which consists of two parts: buyers and sellers. As soon as a buyer and seller agree on a price, the transaction is executed by Binance and BTC is transferred from the seller to the buyer.

What is the priority of orders in the order book?

As mentioned above, Order Book is the place where all buy and sell orders for an asset are displayed. Hundreds and thousands of buy and sell orders may be registered. The question is, with what priority do exchanges display these orders? Which order is at the top of this list, and which order is in the next row?

Let’s say you want to sell bitcoins. Naturally, your preference is to sell your bitcoins at the highest possible price. On the other hand, a person who wants to buy BTC prefers to buy this cryptocurrency at the lowest price.

Exchanges provide the same demand and preference of buyers and sellers in the order book. In the sellers section, the order that recorded the lowest price among other sellers will be placed at the top of the list, and the first order will be the order book.

On the contrary, in the buyers section, the order that offers the highest price among the buyers will be placed at the top of the list, and the first purchase order will be the order book.

In other words, the first sell order in the order book is the highest possible price at which the buyer can buy that asset, and the first buy order in the order book is the lowest price at which the seller can sell that asset.

The concept of Ask and Bid and liquidity power

After knowing the order book in the spot market, it is not difficult to learn the two concepts of Ask and Bid. Ask and Bid refer to two specific prices in the Order Book. The “bid price” refers to the highest price that the buyer is willing to pay for the purchase of an asset.

Ask price refers to the lowest price at which the seller has sold his asset. In the order book, the Bid price is the price that is shown at the beginning of the buyers’ order list, and in an Order Book, the Ask price is the price that is at the beginning of the seller’s order list. The image below shows these two concepts on the Binance exchange.

The smaller the difference between the highest price in the seller’s section – Ask price – and the lowest price in the buyer’s section – Bid -, the greater the liquidity in that market. For example, Bitcoin has very high liquidity on the Binance exchange because the difference between the price offered by buyers and sellers is very small.

The Order Book is the place where all buy and sell orders for an asset are displayed, with the highest price among buyers being placed at the top of the list and the first purchase order being the order book.

Types of trading orders

In this section, we will mention the types of trading orders in spot markets. There are different types of buy or sell orders, or buy and sell orders, in financial markets. If you have worked with exchanges such as Binance, you have probably come across the options provided by Binance when buying and selling a digital asset. In this section, we explain these orders:

· Limit Order

A limit order or an order with a fixed price is one of the easiest types of buying and selling orders. You can see this order in the picture below.

Suppose we want to buy 1 bitcoin for $13,200. When placing an order with this method, two parameters must be determined: the price and the purchase amount. We enter the purchase price in the Price field and the purchase amount in the Amount field. Finally, by registering the Buy or Sell button, your order will enter the Order Book.

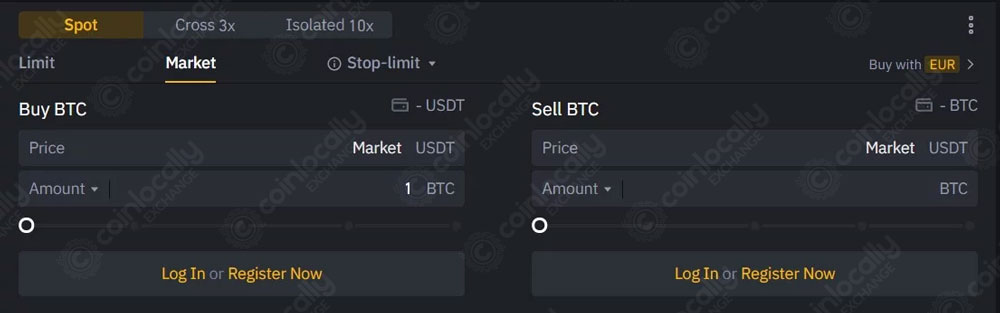

· Market Order

In this type of order to buy and sell a digital asset, we only determine the amount to buy or sell and give Binance the permission to sell or buy the asset we need at the price of the last transaction in the market.

As shown in the image above, the word “Market” is written in the Price section. We do not record a specific price in this order.

· Stop-limit

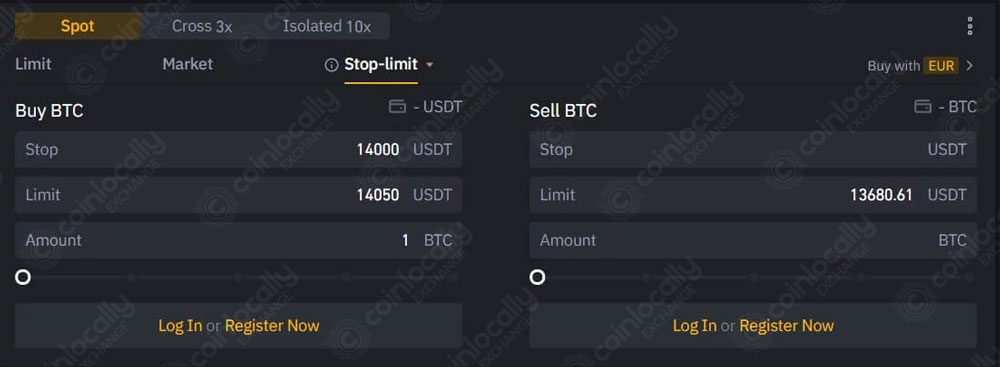

This type of order is divided into two subcategories. Stop Limit Order provides more parameters to the trader compared to the previous two orders. First, we will introduce Stop-limit.

Stop Limit Order is the same as Limit Order, with the difference that there is a precondition for this order to be activated. For example, the price of Bitcoin is currently $13,500 and your goal is to buy it when the price crosses the $14,000 resistance.

So if the price of Bitcoin exceeds $14,000, this is the condition of your order. This condition is called “Stop.” To register this order, three components are needed: the purchase price or Limit, the purchase amount or Amount, and the purchase condition, or Stop.

Binance finally executes your order according to the price you registered in Limit. But this order will be placed in the Order Book if the Stop price condition is established. In fact, after the Stop condition is satisfied, this order will become a Limit Order.

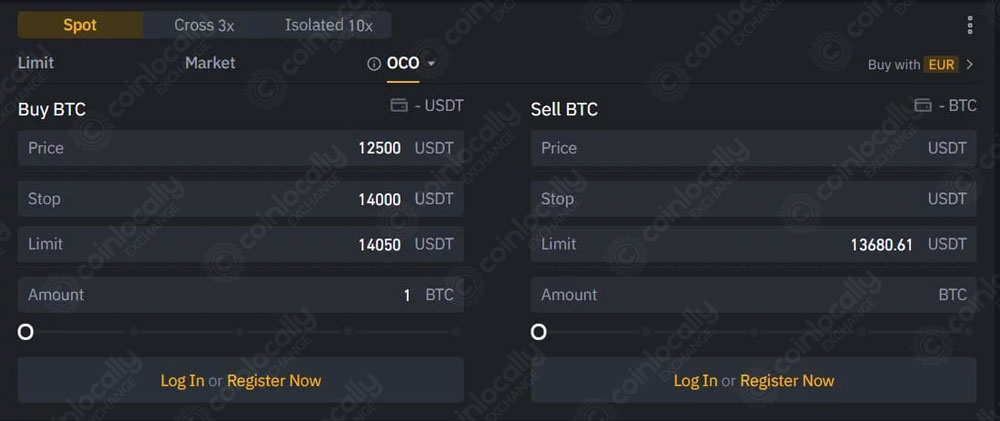

· OCO Order

OCO is an abbreviation for “One Cancels the Other.” This order is a combination of Limit Order and Stop Limit Order. When one of these conditions is met, the other order will be canceled.

In this order, four components are determined by the trader: In the Amount section, the amount of the order is entered, for example, 1 Bitcoin. In the Price section, a price entered in the Order Book is entered, and as soon as the Bitcoin price reaches this set price, the order is placed.

The Limit section is also the price at which the trader intends to buy this asset, but this order has a Stop or precondition. The price entered in the Limit will be entered in the Order Book only if its condition, i.e., Stop is activated; otherwise, this order will not be entered in the Order Book.

Let’s end the discussion of orders with an example. Suppose that the price of Bitcoin is currently $13,200. According to your analysis, $14,000 represents resistance and $12,500 represents support for Bitcoin.

According to your trading strategy, if Bitcoin breaks $14,000, you will buy it, or if the price of Bitcoin reaches $12,500, because it is a support point for Bitcoin, you will buy it. In the case that the purchase of bitcoins takes place at two different points, you need an OCO order. Enter the number 12500 in the Price section.

As the price of Bitcoin is currently in the range of 13200 dollars, your order will be entered in the order book at the same moment, and if Bitcoin reaches 12500 dollars, your order will be completed.

In the Stop field, enter the entry condition for the other mode, which in this example is $14,000. In other words, you tell Binance to book my order if the price of Bitcoin breaks $14,000, but at what price? Enter this price in the Limit field, for example, $14,050. When Bitcoin breaks $14,000, your purchase order will enter the order book at the price of $14,050.

Note: The sales order will be the same as above, and there is no difference.

Trading orders in spot markets include limit orders, market orders, and stop-limit orders. Limit orders require two parameters to be determined: the price and purchase amount. Market orders only determine the amount to buy or sell and give Binance permission to sell or buy the asset at the price of the last transaction. Stop-limit orders require three components to register: the purchase price or Limit, the purchase amount or Amount, and the purchase condition, or Stop. OCO orders require four components: Amount section, Price section, Limit section, and Stop section.

Which spot market is better, OTC or exchange?

The spot price is updated in real time whenever a trade is executed. Spot transactions in the over-the-counter market work differently. In these types of markets, which are explained below, you can coordinate the price and volume of the transaction with the other side of the transaction in advance without using Wordbook.

Spot trading is not limited to a specific location and platform. While many users can make spot trades on exchanges, you can trade directly with others without the use of an intermediary. As explained above, this type of trading is called over-the-counter, or OTC trading. Each spot market has its own characteristics, which we will mention below.

OTC market

On the other hand, we have OTC trading, also known as over-the-counter trading. Financial assets and stocks are traded directly between brokers and traders. To organize spot trading transactions in these markets, different communication methods are usually used, including mobile phones and messengers.

These markets have many advantages, including the fact that there is no need for an order book. If you are trading a currency with a small market capitalization and low liquidity, a large order size can cause a lot of slippage.

Exchanges generally cannot fill such orders in full at your asking price, so you need to place your order with a higher amount. This is why large trades on the OTC include fairer prices. Note that even highly liquid assets such as Bitcoin can experience higher slippage when order volume is high. Therefore, it is more affordable to make large transactions with the first digital currency in these markets.

Spot trading is not limited to a specific location and platform, and can be done directly with others without the use of an intermediary. OTC trading, also known as over-the-counter trading, has advantages such as no need for an order book and fairer prices. It is also more affordable to make large transactions with the first digital currency in these markets.

Advantages and disadvantages of spot trading

Every type of trading strategy you adopt has its advantages and disadvantages. Understanding the strengths and weaknesses of a method can help you reduce investment risk. In the following, we introduce the advantages and disadvantages of spot trading, which is among the simplest trading methods.

Advantages of spot markets

Pricing is transparent, and the supply and demand mechanism causes changes in prices. Contrast this concept with the futures market, where there are sometimes multiple reference prices for an asset. For example, the reference price in the Binance futures market is derived from various information, including the funding rate and the index price. In some traditional markets, the reference price was influenced by the interest rate.

Spot trading is straightforward to use because of the simple rules and easy reward and risk calculations. For example, in spot trading, when you invest as much as $500 in Binance Coin, you can easily calculate your risk by considering the entry price and the current market price.

You can place your order and forget it (Set and Forget). Unlike other derivative markets and margin trading, you don’t need to worry about liquidation or margin calls. You can enter or exit a trading position whenever you want. Also, you don’t need to check your trades constantly unless you plan to make short-term trades.

Disadvantages of spot markets

Depending on the asset you are trading, spot trading may not be appropriate for some assets that are not worth holding. The best example is commodities. If you buy crude oil, you also have to think about its physical delivery. In the world of digital currencies, by holding tokens and coins, you are responsible for keeping them safe.

For certain assets owned by individuals and companies, price stability is very important. For example, a company that plans to operate abroad needs access to foreign currencies in the forex market. If they are dependent on spot market prices, cost and revenue planning may be highly unstable.

Earning potential profits in the spot market is much lower than in the futures and margin markets.

Spot trading is one of the simplest trading methods, as pricing is transparent and the supply and demand mechanism causes changes in prices. It is straightforward to use due to the simple rules and easy reward and risk calculations. However, spot trading may not be appropriate for some assets that are not worth holding, such as commodities. For certain assets owned by individuals and companies, price stability is important, as they are dependent on spot market prices. Earning potential profits in the spot market is much lower than in the futures and margin markets.

Conclusion

In this article, we learned about the concept of spot trading and how it works in the cryptocurrency market. We also learned the difference between Spot Trading and Bitcoin Futures. In this trading market, there are all kinds of orders that we have learned about. Almost all the transactions that are done in Iran and in the field of cryptocurrencies are in the form of spot transactions.

Outside of Iran, in addition to these types of transactions, there are also futures contracts that offer more choices to traders. But still, this type of transaction is one of the most popular in the digital currency market. In the comments section, be sure to express your experience regarding spot transactions of digital currencies in Iran and the issues and problems associated with Iranian exchanges.